How to Budget for Holiday Spending [Stress Free]

Assessing Your Financial Situation

Understanding Your Income

A crucial first step in assessing your financial situation for holiday spending is a comprehensive understanding of your income. This involves more than just your salary; it includes any additional income sources such as freelance work, side hustles, investment dividends, or other forms of passive income. Thoroughly documenting all income streams allows you to accurately determine the total funds available for holiday budgeting and helps prevent overspending.

Analyzing your income patterns over the past year, noting seasonal fluctuations or one-time bonuses, provides valuable context. Understanding how your income varies throughout the year can help you strategically allocate funds for holiday spending, making sure you're not overextending yourself during peak spending periods.

Categorizing Your Expenses

To accurately assess your financial position, meticulously categorize your expenses. This involves dividing your spending into different categories, such as housing, food, transportation, entertainment, and debt repayment. Detailed expense tracking reveals where your money is going, allowing for identification of areas where you might be able to cut back to free up funds for holiday spending.

Evaluating Your Debt Obligations

A significant factor in assessing your financial situation is evaluating your existing debt obligations. This includes all outstanding loans, credit card balances, and any other forms of debt. Listing these debts with their respective interest rates and minimum payment amounts will give you a clear picture of your financial commitments. Understanding your debt situation is crucial for planning realistic holiday spending, as you need to factor in repayment obligations alongside gift-giving and other holiday expenses.

Analyzing Your Savings

Assessing your savings is essential for a realistic holiday budget. Reviewing your savings accounts, emergency funds, and any other savings vehicles provides a snapshot of your financial reserves. Understanding the amount available in savings accounts is critical for determining how much you can afford to spend without jeopardizing your financial security. By accurately evaluating your savings, you can set realistic spending limits and avoid unnecessary financial strain during the holidays.

Identifying Holiday Priorities

Defining your holiday spending priorities is crucial. Consider what truly matters to you during the holidays. This might include spending time with family, buying gifts, traveling, or participating in specific traditions. Prioritizing these aspects allows you to focus your spending on the things that hold the most value, making your holiday budget more manageable and fulfilling.

Creating a Realistic Budget

Developing a realistic budget is paramount to stress-free holiday spending. This involves allocating a specific amount for holiday expenses based on your income, expenses, and savings. A realistic budget considers your current financial situation and ensures you allocate funds to essential expenses without compromising future financial stability. This budget should be flexible enough to accommodate unexpected expenses but firm enough to prevent overspending.

Contingency Planning

Finally, incorporating contingency planning into your holiday budget is crucial to mitigate potential financial surprises. This involves setting aside a small portion of your budget for unexpected expenses. It could be for unexpected travel costs, last-minute gift purchases, or unforeseen circumstances. Having a contingency fund allows you to adapt to unforeseen circumstances without disrupting your holiday budget and causing unnecessary stress.

Creating a Realistic Holiday Budget

Defining Your Holiday Spending

Before diving into the specifics of budgeting, it's crucial to clearly define your holiday spending goals. Are you aiming for a lavish celebration, a cozy gathering with close friends and family, or a more modest, yet meaningful, experience? Understanding your desired level of spending will serve as a compass throughout the budgeting process. This initial step will help you stay on track and avoid overspending. It’s important to consider all aspects of the holiday, from decorations to gifts to travel.

Identifying your priorities is key. What activities and traditions are most important to you during the holidays? Are you looking to create lasting memories with loved ones? Do you want to spread holiday cheer to those less fortunate? By prioritizing these aspects, you can allocate your resources effectively and ensure that your budget aligns with your values. Be realistic about your financial capabilities and avoid getting caught up in the pressure to keep up with others.

Tracking Your Expenses

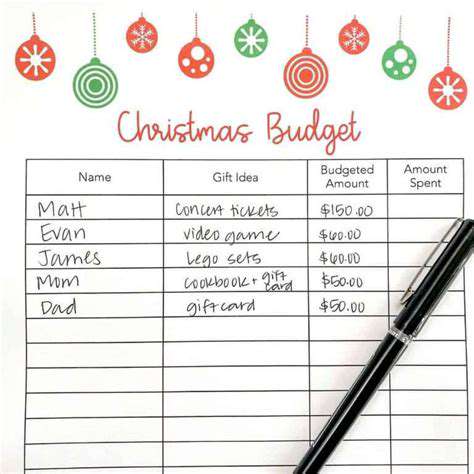

Accurately tracking your expenses is essential for creating a realistic holiday budget. This involves meticulously recording every expenditure related to the holidays, from the cost of decorations and gifts to travel expenses and entertainment. This detailed record will provide valuable insights into your spending habits and pinpoint areas where you can potentially cut back.

Utilizing budgeting apps or spreadsheets can be extremely helpful in this process. These tools can categorize expenses, track your progress towards your budget, and even offer visual representations of your spending patterns. This will allow you to see where your money is going and identify potential areas for savings. Regularly reviewing your spending records will help you stay informed and adjust your budget as needed.

Estimating Holiday Costs

Estimating the total cost of your holiday activities is a crucial step in creating a realistic budget. This involves assessing the costs associated with decorations, gifts, food, entertainment, travel, and any other anticipated expenses. Consider the number of people you'll be entertaining and the scale of each activity. Factor in potential unexpected costs, such as last-minute purchases or unforeseen events. Thorough cost estimation will prevent unpleasant surprises and allow you to make informed decisions about your spending.

Don't forget to factor in potential hidden costs, like wrapping paper, gift tags, or extra food for unexpected guests. Taking these potential costs into account can help you create a more comprehensive and accurate holiday budget. Detailed estimation prevents overspending and promotes financial responsibility.

Creating a Savings Plan

Planning for holiday expenses in advance allows you to allocate funds and avoid last-minute stress. Establishing a savings plan ensures you have the necessary funds available to cover your holiday expenditures. Breaking down the total estimated cost into smaller, manageable monthly savings goals will ease the burden and make the savings process less daunting. This approach allows you to gradually accumulate the funds you need without feeling overwhelmed.

Consider setting up automatic transfers to a dedicated holiday savings account. This approach ensures consistent savings and reinforces the commitment to your holiday budget. Regular savings will make the holiday season less stressful and more enjoyable. This planning also promotes financial discipline throughout the year.

Read more about How to Budget for Holiday Spending [Stress Free]

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Investment Strategies for Volatile Markets [2025]](/static/images/30/2025-05/StrategicAssetAllocation3AAdaptingtoMarketConditions.jpg)

![How to Create a Monthly Budget That Works [2025 Guide]](/static/images/30/2025-05/ReviewingandRevisingYourBudgetRegularlyforLong-TermFinancialStability.jpg)